Trump Accounts: Having a baby in 2025? With rising costs for things like baby formula, diapers, and childcare (up about 5% this year), President Donald Trump’s new “Trump Accounts” could give your newborn a strong financial kickstart with a $1,000 government deposit. This isn’t money you can spend right away – it’s a starter amount placed in a special savings account meant to grow over time, similar to a retirement fund but designed for a child’s future needs like college or buying a home.

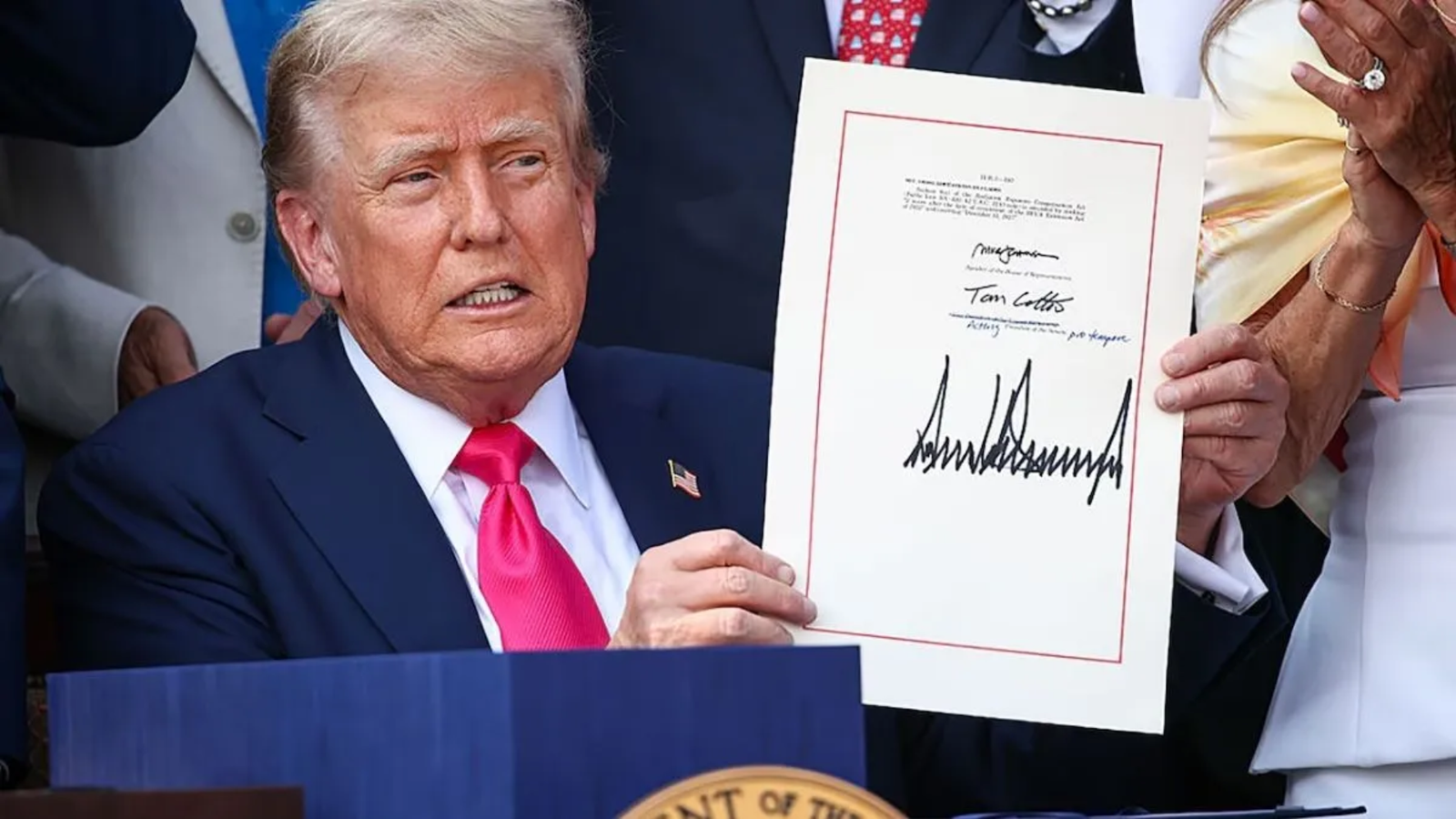

Part of the One Big Beautiful Bill Act (OBBBA) signed on July 4, 2025, these accounts – originally dubbed “Money Accounts for Growth and Advancement” or MAGA accounts – aim to help every U.S. baby build wealth from day one, no matter their family’s income. But who qualifies, how does it grow, and how do you sign up? In this straightforward guide, we’ll cover it all in plain language, with tips for new parents. Based on the latest from the IRS, Treasury Department, and updates as of December 10, 2025, here’s your complete overview of Trump accounts 2025 – so you can get started without the stress.

What Are Trump Accounts? The Basics of the $1,000 Baby Benefit

Trump Accounts are a type of tax-free savings plan for children, blending features of a Roth IRA (for retirement) and a 529 plan (for education), but flexible for broader life goals. The federal government contributes $1,000 as a one-time starter deposit for eligible newborns, invested in low-risk options like U.S. Treasury bonds or broad stock index funds to encourage steady growth over years. With compound interest – where earnings build on themselves – that initial $1,000 could double or triple by the time your child is 18, all tax-free if used correctly.

The program’s goal is to give every American child a fair shot at building wealth, reducing the gap where wealthier families pass down advantages while others start from scratch. Trump described it as a “baby shower from Uncle Sam” during the signing ceremony. Funded by the Treasury, it costs about $13 billion over four years for roughly 3.6 million births annually – a small piece of the $4 trillion OBBBA package. Parents or guardians can add up to $5,000 per year pretax (like a workplace retirement plan), letting the account grow tax-free until the child turns 18 for uses like tuition, a home down payment, or rolling into a retirement account.

The $1,000 deposit is automatic for those who qualify – no income limits or special requirements beyond citizenship. However, experts point out that while it’s a great start, families with more resources might contribute the max, potentially widening wealth gaps unless low-income families get extra support.

How the Benefit Grows Over Time: Simple Examples

Invested wisely (aiming for 4-6% average annual returns from safe bonds or diversified stocks), the $1,000 can grow significantly. For instance, at 5% yearly return, it reaches about $1,276 in 5 years or $2,406 in 18 years. If parents add $2,500 annually, the account could hit $75,000 by age 18. Withdrawals are tax-free for qualified purposes (education, first home up to $10,000, or retirement rollover); otherwise, a 10% penalty plus taxes applies, similar to other savings plans.

Who Qualifies for the $1,000 Trump Baby Benefit?

The beauty of Trump Accounts is their broad reach – no means-testing, so every eligible family gets the $1,000 starter. Core requirements:

- The baby must be a U.S. citizen born between January 1, 2025, and December 31, 2028 (tied to Trump’s term).

- The child needs a valid Social Security number (SSN), typically issued at birth by the hospital.

- A parent, guardian, or legal representative must open the account (anyone can do so for children under 18).

Children born before 2025 but under 18 miss the $1,000 deposit but can still open accounts with up to $2,500 in annual pretax contributions. A major boost came on December 2, 2025, when Michael and Susan Dell pledged $6.25 billion for $250 grants to 25 million children aged 10 and under in low-income ZIP codes (median household income under $150,000) – apply through the Invest America nonprofit, often automatically if eligible. Undocumented children don’t qualify due to the SSN rule, but adopted or foster kids do if they’re U.S. citizens.

Qualification overview table:

| Requirement | Details | Notes |

|---|---|---|

| Birth Date | January 1, 2025 – December 31, 2028 | Aligns with Trump’s term; older kids under 18 miss $1,000 but can open accounts |

| Citizenship | U.S. citizen | SSN required at birth (free from hospital) |

| Account Setup | By parent/guardian or representative | Free online; open anytime before child turns 18 |

| Income Limits | None | Open to all families; Dell $250 grant for low-income ZIPs (kids under 11) |

| Extras | $250 Dell grant if eligible | Automatic for many; apply via Invest America by December 31, 2025 |

How to Claim Your Trump Account and the $1,000 Deposit

Getting started is hassle-free – no need for paperwork at the hospital, but act soon after birth to lock in the deposit. Here’s the step-by-step:

- Obtain the SSN: Your hospital or birthing center provides this free of charge; it usually takes 2-4 weeks. If delayed, contact the Social Security Administration at 800-772-1213.

- Open the Account: Head to IRS.gov/TrumpAccounts (launching January 2025) or TreasuryDirect.gov. Enter the child’s SSN and your information as the account holder – the process takes about 10 minutes online.

- Submit Form 4547: This simple election form triggers the $1,000 “pilot contribution” from the Treasury. You can file it anytime, even with your 2025 tax return (due April 2026), and the deposit appears within 30 days.

- Select Investments: The default is low-risk Treasury bonds; opt for stock index funds if you want higher potential growth through the portal’s options.

- Make Contributions and Monitor: Link your bank account for pretax deposits up to $5,000 per year; use the mobile app or website to track the balance and performance.

For the Dell grant: If your child’s ZIP code qualifies (low median income), apply at InvestAmerica.org by December 31, 2025 – it’s often automatic with no extra steps for many families. Non-citizen parents can have a U.S. guardian open the account. Have questions? Call the IRS at 800-829-1040 or use their online chat support.

Potential Hiccups: Common Rules to Watch For

Enter the wrong SSN? The deposit delays – double-check everything. Need to withdraw early? You’ll face a 10% penalty plus taxes on earnings. Lose access to the account? Re-link it through the portal with ID verification. While praised as a “baby bonds” win, critics say it doesn’t address immediate family needs like paid leave, but it’s a solid, hands-off way to build security.

How the Money Grows: Real-Life Examples for Your Family

With conservative investments (targeting 4-6% annual returns from bonds and stocks), the $1,000 grows nicely. At 5% return, it becomes $1,276 in 5 years or $2,406 in 18 years. Add $2,500 yearly from parents? The account could reach $75,000 by age 18. Funds are for qualified uses like tuition, a first home (up to $10,000 without penalty), or rolling into a Roth IRA; parents control it until the child is 18, then they take over. Compared to a 529 plan, Trump Accounts offer more flexibility beyond just education.

Growth projection table (at 5% average annual return):

| Time Frame | $1,000 Grows To | With $2,500 Yearly Parent Adds |

|---|---|---|

| 5 Years | $1,276 | $15,000+ |

| 10 Years | $1,629 | $35,000+ |

| 18 Years | $2,406 | $75,000+ |

*Returns vary by market; conservative estimates based on historical data.

Protecting Yourself: Spotting Scams Around the Baby Benefit

With the program’s popularity, scammers are circling – watch for texts or emails like “Claim your $1,000 baby bonus – pay a $20 processing fee” or fake websites asking for your SSN upfront. The IRS never charges for benefits or demands personal info via email; always use official sites. Report suspicious contacts to FTC.gov immediately. Stick to IRS.gov/TrumpAccounts and TreasuryDirect.gov – that’s your safe path.

Frequently Asked Questions (FAQ)

What is the Trump $1,000 baby benefit?

It’s a one-time $1,000 government deposit into a tax-free savings account for U.S. citizen newborns from 2025 to 2028, designed to grow for the child’s future like education or a home.

Who qualifies for Trump Accounts and the $1,000 deposit?

U.S. citizen babies born 2025–2028 with an SSN; no income limits – parents open for any child under 18, though older ones miss the $1,000.

How do I claim the $1,000 for my baby’s Trump Account?

Get the SSN at birth, then open the account at IRS.gov/TrumpAccounts (January 2025 launch) and file Form 4547 – the deposit arrives in 30 days.

Can older children get Trump Accounts?

Yes – kids under 18 can open with up to $2,500 yearly pretax adds; those under 11 in low-income ZIPs may get a $250 Dell grant.

Is the $1,000 baby benefit taxable?

No – the deposit and qualified growth are tax-free; parent contributions are pretax, like a 401(k).

Conclusion

Trump Accounts 2025 offer a promising $1,000 baby benefit for U.S. citizen newborns through 2028, seeding tax-free growth for education, homes, or retirement – accessible to all with no income barriers, and enhanced by the Dells’ $6.25 billion for 25 million older kids in need. Open the account at IRS.gov/TrumpAccounts after getting the SSN, file Form 4547 for the quick deposit, and add up to $5,000 yearly pretax to reach $75,000+ by age 18.

While it doesn’t fix immediate childcare costs, it’s a bipartisan step toward baby bonds, with flexible uses beyond school. Avoid scam fees promising “instant claims”; use official Treasury and IRS sites only. For low-income ZIP grants, apply via Invest America by December 31. As family expenses mount, this program turns new beginnings into lasting security – launch yours in January and let it compound. Visit Treasury.gov for more details; your baby’s brighter tomorrow starts today.